Vancouver, British Columbia - Centenera Mining Corp. ("Centenera" or the "Company") - (TSXV: CT), reports the results of drill targeting on the Company's flagship Organullo Gold Project ("Organullo" or the "Project") located close to San Antonio de los Cobres in Salta Province. The Company retained Robin Rankin of GeoRes, a leading Australian geological consultancy, to complete drill targeting on the Project. A total of 30 drill targets have been defined, of which 17 are described as either very high or high priority. Extensive surface sampling has been initiated, expanding beyond the established target areas, to explore untested areas of alteration interpreted from Aster imagery and mapping.

Drill Target Details

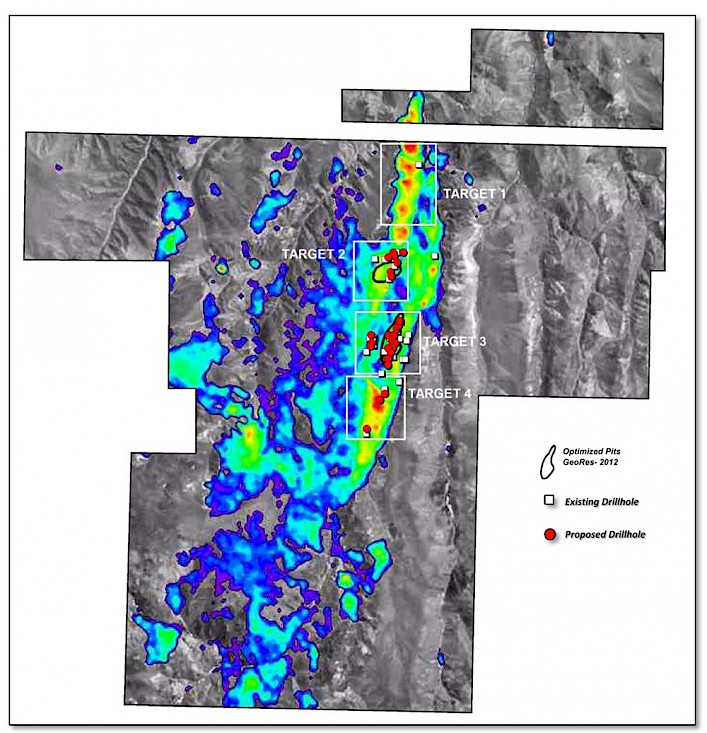

Having defined 4 target areas in December 2015, drill targeting focused on target areas 2, 3 and 4 only (Figure 1), with target area 1 requiring additional surface sampling. A total of 30 drill targets are defined for a total of 4,300 meters of proposed drilling. Drill targets are limited to an average depth of 140 meters, which is consistent with the objective of defining mineralization with potential for surface extraction. The targets established are summarized in the table below:

| Number of Drill Targets | Priority | Meters |

|---|---|---|

| 9 | Very High | 1,300 |

| 8 | High | 1,195 |

| 9 | Moderate | 1,230 |

| 4 | Low | 595 |

Next Steps

The drill targeting completed by GeoRes was focussed on areas where drill testing has already been undertaken and established drill targets to further define mineralization and potentially expand the area of known mineralization. The area drilled historically covers approximately 3 kilometers of strike length, whereas the alteration footprint of the Organullo project, as defined by interpretation of Aster imagery, extends for a strike length of more than 10 kilometers. The Company has initiated extensive surface sampling to screen additional areas and allow meaningful prioritization of targets areas.

Target 2: The target is centred on the northerly of the two optimized pits developed by GeoRes in 2012 and the target has been sampled in some detail at surface. Using the 0.5 g/t cut-off base case, target tonnage and grade varied from 1.8Mt @ 1.69 g/t gold (98,000 ounces) to 9.5Mt @ 1.14 g/t gold (347,000 ounces). The large range in target tonnage and grade reflects that the target is sparsely drilled. Five historical drill holes, 7 new drill targets.

Target 3: The target is centred on the southerly of the two optimized pits developed by GeoRes in 2012 and the target has been sampled in detail at surface. Using the 0.5 g/t cut-off base case, target tonnage and grade varied from 18Mt @ 0.86 g/t gold (498,000 ounces) to 22.1Mt @ 0.83 g/t gold (589,000 ounces). The narrow range in target tonnage and grade reflects that target is drilled in more detail with 28 historical drillholes. Target 3 includes the historical Julio Verne mine, an underground copper-bismuth-gold mine which last operated in the 1930s. 19 new drill targets.

Target 4: Despite having high alteration intensity (dickite, jarosite, with weak kaolinite and alunite/pyrophyllite), the target area has only 3 historical drill holes, none of which effectively test the best alteration. Rock sampling has been completed and there are significant anomalies at surface. 4 new drill targets.

Figure 1: Proposed Drillhole Locations on Target Areas 2, 3 and 4, Organullo.

Background is Interpreted Aster alteration showing Jarosite

Alteration Intensity (red-orange colours).

About Organullo

The Organullo project is a relatively advanced exploration project, located close to the Company's new Trigal gold project (see previous news release, December 1, 2015). The project has 43 historical drillholes totalling 8,174 meters of diamond and reverse circulation drilling. The project has been explored in the past by several companies including Triton Mining Corp., Northern Orion Explorations Ltd., Newmont Mining, and Cardero Resource Corp ("Cardero"). A report, "Organullo Exploration Targets & Pit Optimization", dated June 6, 2012, is authored by Robin Rankin of GeoRes. The work resulted in (i) potential exploration target tonnages and (ii) potential exploration target grades of gold at the Organullo property, which were reported at lower and upper ranges.

Table 1: Estimation of Target Tonnage and Grade at Organullo

| Target Range | Base Case Gold Cut-Off g/t | Tonnage (x ‘000) | Gold Grade g/t |

Gold Ounces (x ‘000) |

|---|---|---|---|---|

| Lower | 0.5 | 19,800 | 0.94 | 600 |

| Upper | 0.5 | 31,600 | 0.92 | 940 |

Estimation of target tonnage and grade was determined using two common strike and dip directions, each characteristic of a specific exploration target area. Block models were built for two target areas. Block sizes were defined to emphasise the narrow vein orientation and gold grades were estimated into each model's blocks using parameters adapted to the common vein direction in each area. Raw drillhole data was composited to 2.0 meters downhole. No limits were applied to either input data or output estimates and the estimation scan distances of up to 100 meters in the plane of the veins was adequate to fill the blocks between drill holes and extended was unconstrained by geology. Block estimation was done using an inverse distance squared algorithm. Following this evidence, increasing the scan distances by simple multiples produced reasonable figures for ranges of exploration targets. Scan distances of 200 meters and 300 meters were used for lower and upper ranges of exploration targets. It should be noted that these potential exploration target quantities and grades are conceptual in nature, that insufficient exploration and geological modelling has been done to define a mineral resource, and that it is uncertain if further exploration will result in the delineation of a mineral resource.

Qualified Person

EurGeol Keith Henderson, PGeo, the Company's President & CEO and a qualified person as defined by National Instrument 43-101, has reviewed the scientific and technical information that forms the basis for portions of this news release, and has approved the disclosure herein. Mr. Henderson is not independent of the Company, as he is an officer and shareholder.

About Centenera Mining Corporation

Centenera is a resource company trading on the TSX Venture exchange, symbol CT. The company is focused 100% on Argentina with three precious metals assets and extensive exploration datasets. The Company's strategy is to acquire more high-quality precious metal and copper assets.

Argentina is a country rich in natural resources and is home to some of the largest mineral deposits in South America and employs more than 500,000 workers directly in its mining industry. The world's largest mining companies, such as Glencore, Barrick, AngloGold and Yamana have invested heavily in Argentina over the last 10 years and multiple mine construction & expansion projects are in progress or imminent. The country held Presidential elections in October 2015 and a run-off election in November 2015. The opposition candidate, Mauricio Macri, won the election, bringing a change of government. The election was won on promises to make substantial changes to existing policies, with economic reform at the top of the agenda. In an underexplored, highly prospective country, the changing political landscape presents an exciting opportunity.

For more information on the Company's board of directors, management and assets, please refer to the web site at www.centeneramining.com.

On Behalf of the Board of Directors of

CENTENERA MINING CORPORATION

"Keith Henderson"

President & CEO

For further details on the Company readers are referred to the Company's web site (www.centeneramining.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Phone: 604-638-3456

E-mail: info@centeneramining.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release, which has been prepared by management.

Cautionary Note Regarding Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented on this website and the information incorporated by reference herein, constitutes "forward looking information" within the meaning of applicable Canadian securities laws concerning the business, operations and financial performance and condition of Centenera Mining Corporation ("the Company"). All statements, except for statements of historical fact, that address activities, events or developments that management of the Company expects or anticipates will or may occur in the future including such things as future capital expenditures (including the amount and nature thereof), business strategies and measures to implement strategies, competitive strengths, goals, expansion and growth of the business and operations, plans and references to the future success of the Company, and such other matters, are forward looking statements. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mining development, actual results of exploration activities, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of metal, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading "Risk Factors" in the Information Circular (May 2014) and discussed in the annual management's discussion and analysis and other filings with the Canadian Securities Authorities of the Company.

Shareholders are cautioned not to place undue reliance on forward looking information. The Company undertakes no obligation to update any of the forward looking information on this website or incorporated by reference herein, except as otherwise required by law.